📄 Trading Blog

AI, Automation, Trading strategies

When You’re in a Drawdown

Instagram traders will make you believe that once you figure out how to make money trading, you’re on the easy street to all your dreams.

However, real-life day trading, even when you have achieved success in trading, is far from easy. The pressure of maintaining the income for your lifestyle, be it a house, toys (cars, bikes), holidays, or private school fees, amplifies every time you’re in a drawdown. Panic sets in that this is it - you've had it. You will lose all these privileges and will never be a profitable trader again.

Comparing Manual and Computer Backtesting: Benefits and Disadvantages for Retail Traders

Backtesting strategies is an essential part of trading, and the most successful traders will always backtest before making a trading decision. Traders use backtesting to evaluate the effectiveness of a particular strategy, and there are two main methods for doing so: manually backtesting and backtesting with a computer

Are computers better traders than humans?

It's a commonly accepted notion that computers are more precise and efficient than humans, but that doesn't necessarily mean they make better traders, as both have their own strengths and weaknesses. It's true that computers can crunch data and make decisions much faster than humans, but that doesn't mean they can always make the best decisions.

Is backtesting a reliable way to find what strategies will work in the future?

Backtesting is a technique that is used to evaluate the performance of a trading strategy using historical data. The idea is to apply the trading strategy to past data and see how it would have performed in those conditions. This can provide some insight into the potential effectiveness of the strategy.

DRIVERLESS METRO AND TRADERLESS INVESTING.

AI in financial markets is nothing new and it has been used in the markets ever since electronic trading came into existence in the late 1990s. However, the complete shift to AI trading, where humans become obsolete and can not compete with AI, is still some decades away and might not even happen in my lifetime.

HOW A HUMAN ERROR CHANGED MOTORSPORT HISTORY

The outcome of the 2021 world championship, was decided by a “HUMAN ERROR”. A human error by the race director Michael Mosi, who made a simple observation error when he identified which cars should un-lap themselves before the race could be restarted. This allowed Verstappen to win the Abu Dhabi race and his first F1 world championship, and denied Hamilton the chance to win a record-breaking eighth title.

5 STAGES OF BOTS LIFE

Bots' life cycles are very similar to that of humans. It too involves a continuous state of evolving, refining, improving, adapting and changing.

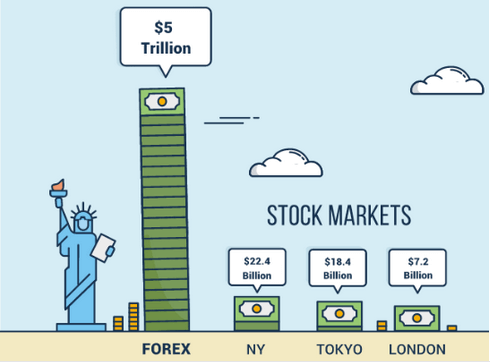

WHAT IS THE FOREX MARKET AND WHY IS IT THE BEST MARKET TO TRADE?

Foreign exchange market or Forex is the largest financial market in the world – larger even than all world’s stock markets combined, with a daily volume of $5 trillion…The Forex market is the best market to trade for independent traders; here are 9 reasons why…

8 REASONS WHY YOU CAN OUTPERFORM YOUR FUND MANAGER.

The top-performing funds in Australia’s Superannuation pension system returns 9% per year, according to StockSpot. These funds have billions of dollars under management, a team of PhD’s and MIT computer scientists at their disposal, and access to better data and more powerful computer equipment worth millions of dollars. So, what are the chances that regular independent traders outperform them?

Quite high, it turns out.

HOW MUCH MONEY DO I NEED TO INVEST?

One of the first basic questions you face when you start investing is: how much money should I be investing?

The “100 minus your age” rule is a good rule-of-thumb to use for this question.

It tells you what portion of your wealth should be in aggressive investments and what portion should be kept in safe investments.

WHAT IS DATA-TRADING?

Algorithms are not just automating many processes, making them more efficient; they are now enabling people and machines to work collaboratively in novel ways.

KEEP CALM AND SAY NO

Trading the markets is much more than simply following statistics. Trading is driven by emotions. Traders around the world make decisions every day on whether the price of something is high or low. If trading were only about data then every programmer from Mumbai would be a billionaire

WHAT IS AI ANYWAY?

We have all seen these sci-fi movies about futuristic droids that are super-intelligent: they swiftly take over the world and make all humans their slaves. The current state of AI could not be further from the truth.

HOW CAN TRIP PLANNING MAKE YOU A BETTER TRADER?

You must plan and do backtesting but you should never assume that the backtest will be the same as live trading. It rarely is.

WHY BINARY RISK MANAGEMENT RULES MAKE NO SENSE

The amount that you risk on each trade is a critical part of your trading and can make or break an entire strategy. Risking the same amount on each trade makes no sense because each trade is placed at different times in the market, with a different level of confidence and potential payoff.

WHAT IS EXPECTANCY?

To understand expectancy first you need to think about your trades in terms of the rewards you may earn for the risk you’re taking: a reward-to-risk ratio.

PREDICTING VS REACTING

Professional traders can make money from the markets because they are very flexible and they have no strong opinions about any direction of the market. They are just sitting and waiting for trading opportunities that their positive-expectancy system generates.

IT’S NOT MAN VS MACHINE: IT’S MAN+MACHINE!

Humans and Machines have fundamentally different strengths and weaknesses. This is the reason the best trading results can be achieved when using both together.

BENEFITS OF TRADING WITH ROBOTS (SELF-CREATED)

No one cares about your money more than you do. Despite what many financial advisors will have you believe (so they can charge you a hefty fee, naturally) you’re the best person to look after your money. If you invest a bit of time and learn how to algo-trade, you’re perfectly capable of managing your money better than many professionals.

DANGERS OF TRADING WITH ROBOTS (READY-MADE)

One of the biggest misconceptions about algorithmic trading is that beginner trader confuse the high performance of robo-traders with how this performance was achieved. They hear the word ‘robot’ and immediately think of a superhuman beast that does all the trading for them – one that they don’t need to supervise, but just deliver checks every Friday. This is exactly the mirage that most robot-selling sites will tell you. Nothing could be further from the truth.