WHAT IS THE FOREX MARKET AND WHY IS IT THE BEST MARKET TO TRADE?

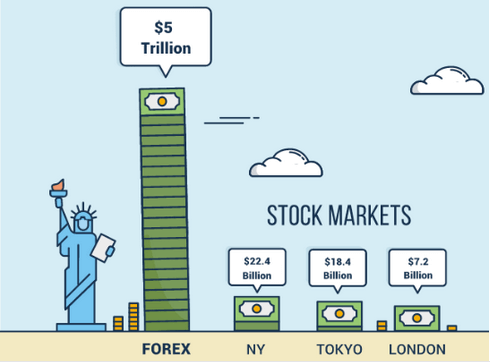

Foreign exchange market or Forex is the largest financial market in the world – larger even than all world’s stock markets combined, with a daily volume of $5 trillion.

It is so vast because every single person and every single company and every single government (via its Central Bank) in the world contributes to it.

When you are buying something online from another country you are exchanging your local currency for another currency – you just traded in the Forex market.

When BMW buys steel from China to produce its newest 5 series Sedan they exchange EUROS for Chinese Yuan and participates in the Forex market.

If you’re an Investor from Europe or Asia and want to invest in Apple – you have to “Buy” USD first before purchasing the Apple stock.

When your local supermarket chain purchases avocados from Mexico it has to “Buy” Mexican Pesos first to pay for those avocados.

The list goes on – one way or another we all participate in the Forex market.

But there is another part of the Forex market unrelated to consumer goods or supply chains – speculation. Any currency’s value is fluctuating every single day. And you can Buy and Sell any or the world's 180 currencies with an aim to return profit. The Forex market is the market of choice for commercial and investment banks but in the last decade, following the rise of electronic trading and inexpensive and powerful online tools, this exclusive market has opened for independent, stay-at-home traders.

The Forex market is the best market to trade for independent traders; here are 8 reasons why:

It is liquid. The Forex market’s $5 trillion daily liquidity provides two major benefits. First, it is stable. You don't need to worry about a crypto whale or a single bank crashing the market making your trading system redundant. Second, it is deep. You don't need to worry about somebody stealing your trade idea and removing your edge. You can literally Buy and Sell billions of dollars in a matter of seconds without affecting the market. There is plenty to go around for everyone.

Low barriers to enter. You can start trading in the Forex market with less than $1,000. The charting platforms are free and you can practise your skill of trading on risk free demo accounts with virtual dollars.

You can trade on margin. Forex brokers let you borrow money up to 100 times your initial capital without any extra costs to you. This means that even with $1,000 you can control $100,000 capital. Of course trading on margin is a double edged sword:If you don't manage your risk, or if you trade on margin without a positive expectancy strategy, you will lose your money very quickly.

It is open 24 hours a day. This means you can take advantage of this market regardless of where in the world you are. The Forex market is split into 3 trading sessions that follow each other 24 hours a day: the Asian session, the European session and the US session each run 8 hours a day, 5 days a week. There will always be some currencies to trade.

Tax free (in the UK and Ireland) – this is huge! All the profits you make are yours to keep with 0% tax. Why would the UK and Irish governments pass such crazy laws? The truth is that the majority of independent traders lose money in the Forex markets and while those making money don't pay any tax, this also means that if you lose money you cannot offset it against your tax bill. For this reason the UK and Irish governments are happy to allow the profitable traders not to pay tax as otherwise they would also need to allow offsetting all the losing traders’ losses. Besides, Forex brokers (intermediaries that allow independent traders access to Forex markers) pay big taxes so everyone is happy.

You can scale your trading. As mentioned above, the Forex market is huge and it scales very well. You can trade with $10 millions exactly the same way you traded with $10,000. This means that you can start small and, provided you have the trading skills and a positive expectancy trading system, the sky’s the limit.

Forex trading is popular. This means not only that there are great resources online about how to trade Forex, there are also ample opportunities to make extra incomes. You can provide trading signals or offer copy trading and managed accounts – here are 8 ways to get extra income as a Forex trader.

You can Automate your trading. Many independent traders have placed their Forex trading on Auto-pilot. There are a lot of resources online on how to automate your Forex trading, both for expert programmers and total beginners whose strategies do not require coding knowledge. At DARA we have such a software that can help you to automate your trading without a single line of code.